We believe that every family deserves the opportunity to own their own home, and our partnership with EastWest Bank brings us one step closer to ...

Read More >Your Loans

Choose the best loan type you can have for your needs.

Know which type of housing loan you need to manage your finances.

Need to buy something? Continue studying? Or going somewhere else?

Other Links

Get Pre-Qualified

Find out if you qualify for a loan in just 3 minutes.

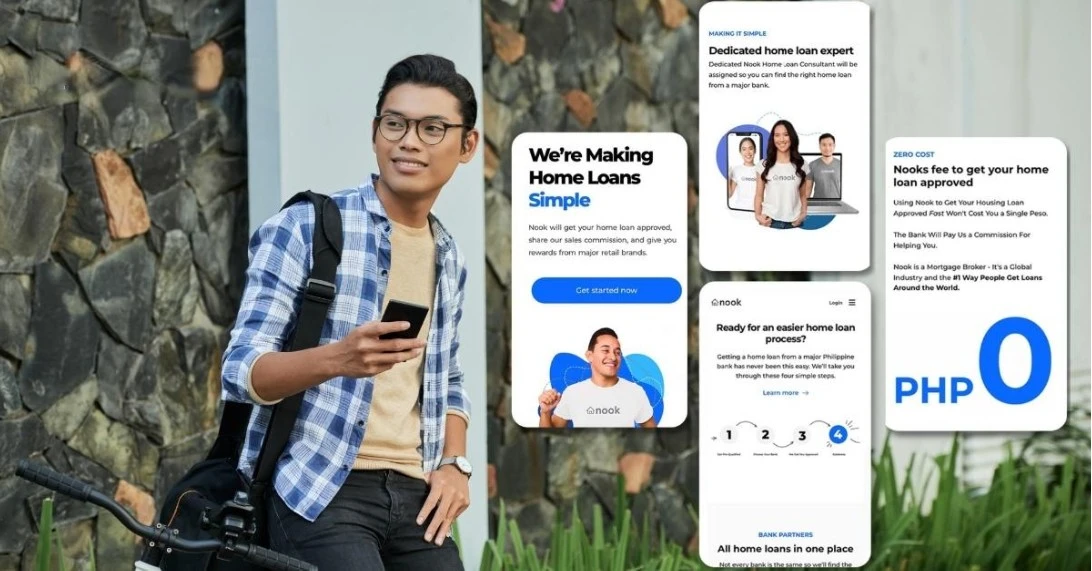

Mortgage Brokering

We help you with your loan transaction at no cost to you.

Book Consultation Call

Get expert advices from our loan consultants for free.

Loan Calculators

Check your financial capacity now.

Partners

Join the many who made the best decision in providing their clients with the best home loan journey available in the country.

Banking Partners

Some of the biggest banks in the Philippines with the goal of making home loans simple.

Strategic and Partner Developers

In coordination with top developers, realty and service providers for B2B connections.

Retail Partners

Get discounts and exclusive deals during your home loan journey from these retails shops.

Affiliate Program

Refer your friends and family to become an affiliate and receive commission plus discounts for every successful referrals.

Latest News

Featured Posts

After introducing their newest service, personal loan assistance, Nook is now on its way to…

Recent Posts

About

Know more about the Philippines' first mortgage broker, how we do it and why only we can do it.

Nook App

Transact more faster with your Nook loan consultant on our app.

Our Process

Processing your loan application can be done with our four simple steps.

About Us

Why we are the first and the only mortgage broker in the country.

Careers

Join the Mortgage Brokering Industry Pioneer, Nook.

Contact Us

Chat to us now from our website and talk to a Live Agent.

Help Center

Tutorials and How-to guides when using Nook's technology.